This week the Fed left interest rates unchanged. In their remarks, they said that they still expect to make three rate drops in 2024 despite inflation remaining above their target rate. They also commented on the strength of the labor market and that they expect unemployment to remain low. They also made reference to easing of other quantitative policies designed to slow the economy. Investors took the news well and stocks surged while bond yields and mortgage rates dropped on expectations of lower rates soon.

Stock markets – The Dow Jones Industrial Average closed the week at 39,475.90, up 2% from 38,714.77 last week. It is up 4.7% year-to-date. The S&P 500 closed the week at 5,234.18, up 2.3% from 5,117.09 last week. The S&P is up 9.8% year-to-date. The Nasdaq closed the week at 16,428.82 up 2.8% from 15,973.17 last week. It is up 9.4% year-to-date.

U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.22%, down from 4.31% last week. The 30-year treasury bond yield ended the week at 4.39%, down from 4.43%last week. We watch bond yields because mortgage rates follow bond yields.

Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of March 21, 2024, were as follows: The 30-year fixed mortgage rate was 6.87%, up from 6.74% last week. The 15-year fixed was 6.21%, up from 6.16% last week.

The graph below shows the trajectory of mortgage rates over the past year.

Year-over-year home prices jumped almost 10% in California – The California Association of Realtors reported that existing-home sales totaled 290,020 in February, up 12.8% from 257,040 closed sales in January and up 1.3% from a revised 286,290 homes sold on an annualized basis last January.There was a 3-month supply of homes on the market in February, down up from a 3.2-month month supply of homes in January and down from a 3.1-month supply one year ago. The statewide median price paid for a home in February was $809,460, up 9.7% from a revised median price of $789,480 last February.

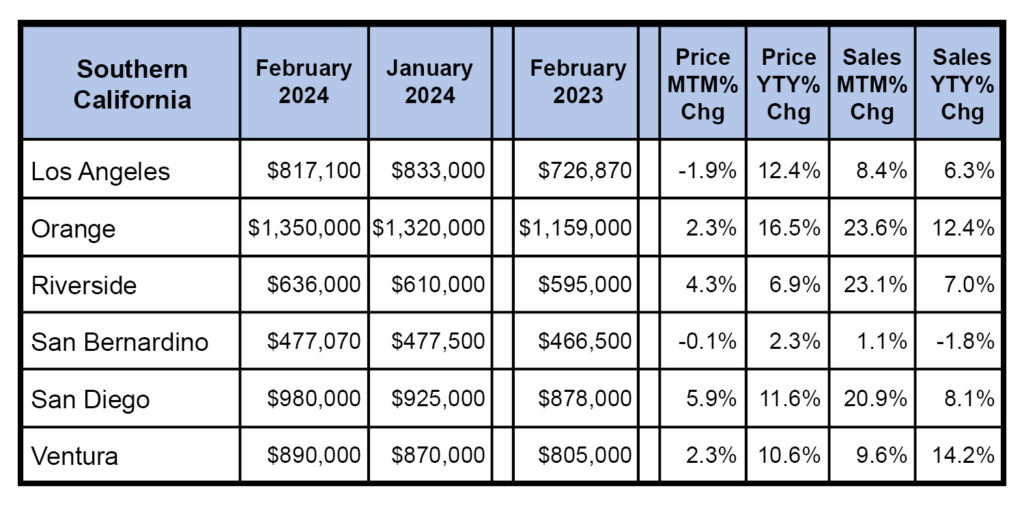

The graph below shows home sales figures by county in Southern California.