U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 0.70%, up slightly from 0.67% last week. The 30-year treasury bond yield ended the week at 1.45%, up slightly from 1.42% last week.

Mortgage rates – The September 17, 2020, Freddie Mac Primary Mortgage Survey reported mortgage rates for the most popular loan products as follows: The 30-year fixed mortgage rate average was 2.87%, unchanged from 2.85% last week. The 15-year fixed was 2.37%, unchanged from 2.37% last week. The 5-year ARM was 2.96%, down from 3.11% last week.

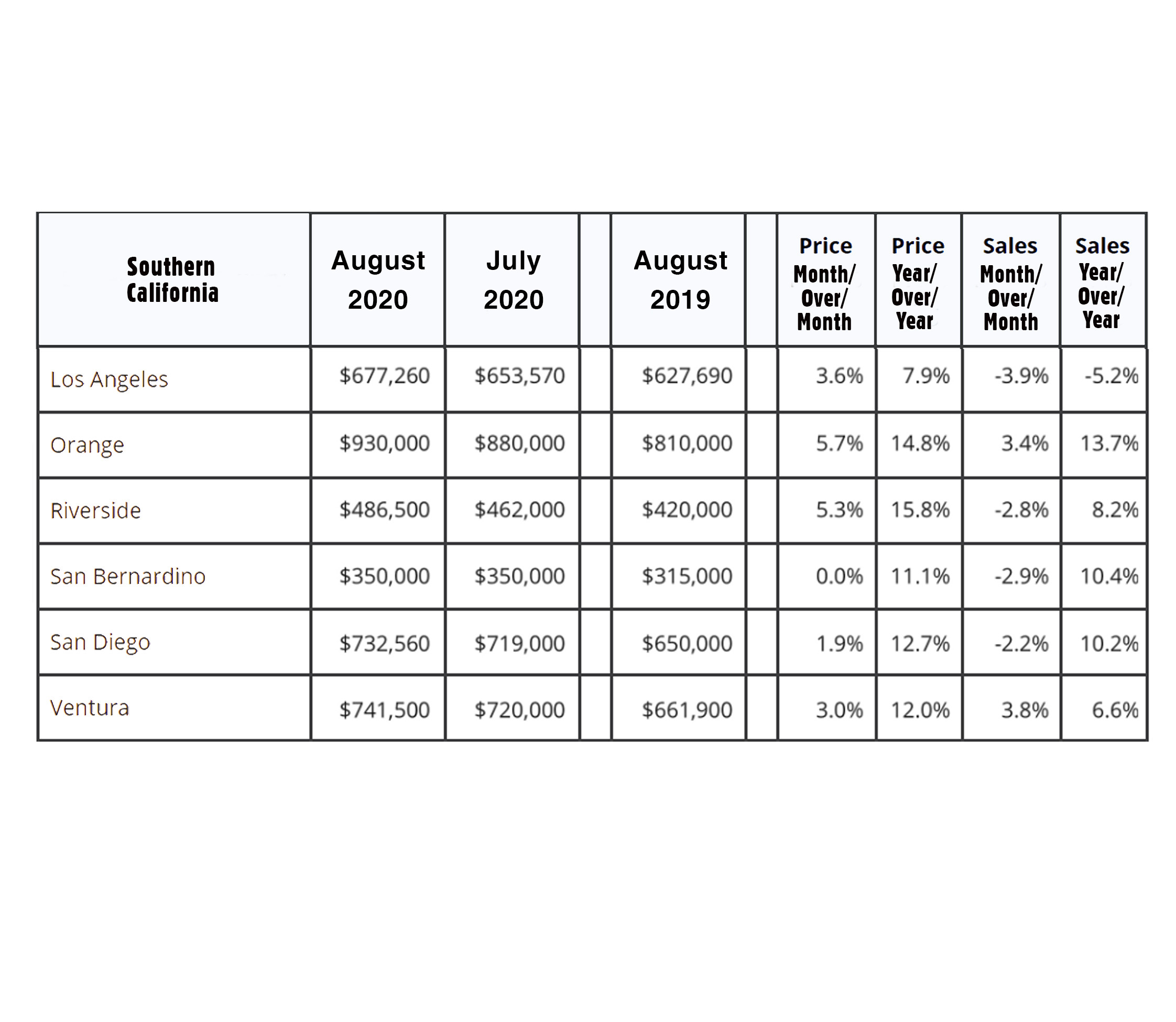

California’s existing-home sales and prices hit a record high in August – The California Association of Realtors announced that existing, single-family home sales totaled 465,400 in August on a seasonally adjusted annualized rate. That marked a month-over-month increase of 16.3% from the number of sales in July. Year-over-year sales were up 14.6% from August 2019’s 406,100 sales on a seasonally adjusted annualized rate. The state-wide median price also hit a record high. It was $706,900, up 6.3% from $666,320 in July. Year-over-year the median price increased by 14.5% from $617,410 last August. That marked the steepest year over-year-increase in the median price since March 2014 when home prices were recovering from steep drops during the Great Recession financial crisis. The median price is the point at which one half the homes sell for more and one half sell for less. Historic low-interest rates with 30-year fixed at or under 3% have increased buyer demand, and very low inventory levels have created competition and pushed prices up. The unsold inventory index in August held steady at a 2.1-month supply. That was unchanged from July, but down from a 3.2-month supply one year ago. A 5-6-month supply is considered a normal market, but we have not seen that high of an inventory rate for many years. The index indicates the number of months it would take to sell the supply of homes on the market at the current rate of sales. The graph below indicates the number of sales and median prices for counties in Southern California.

The graph below indicates results from Southern California by county.