Stock markets dropped for a fourth straight week – Stock markets dropped further this week as fears of higher interest rates due to high inflation sent stocks lower. Comments by Fed Chairman, Jarome Powel on Thursday which included “taming inflation is absolutely essential” led investors to believe that an interest rate hike of at least ½% would be announced at the May 3-4 Fed meeting. Those comments caused the Dow, which was up for the week on Wednesday, to fall almost 1,000 points on Thursday. The Dow Jones Industrial Average closed the week at 33,811.40, down 1.9% from 34,451.23 last week. Its down 7.0% year-to-date. The S&P 500 closed the week at 4,271.78, down 2.8% from 4,392.28 last week. The S&P is down 19.4% year-to-date. The NASDAQ closed the week at 12,839.29, down 3.8% from 13,351.08 last week. It is down 18.0%, year-to-date.

U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 2.90%, up from 2.83% last week. The 30-year treasury bond yield ended the week at 2.95%, up from 2.92% last week. We watch bond yields because mortgage rates often follow treasury bond yields.

Mortgage rates – Home mortgage rates have continued to increase. Freddie Mac Primary Mortgage Survey reported that mortgage rates as of April 21, 2022 for the most popular loan products were as follows: The 30-year fixed mortgage rate was 5.11%, up from 5.00% last week. The 15-year fixed was 4.38% up from 4.17% last week. The 5-year ARM was 3.75%, up from 3.69% last week.

March 2022 home sales – Home sales figures are released in the third week of the month for the previous month.

U.S. existing-home sales – The National Association of Realtors reported that existing-home sales totaled 5.77 million on a seasonally adjusted annualized rate in March, down 2.7% month-over-month from the annualized rate of sales in February. Year-over-year sales were down 4.5% from the annualized rate of 6.04 million in March 2021. The median price of a home in the U.S. in March was $375,300, up 15.0% from $326,300 one year ago. March marked a record 121 consecutive months of year-over-year increases in the median price. Inventory levels remained near record lows. There was just a 2-month supply of homes for sale in March, down from a 2.1 month supply one year ago. First-time buyers accounted for 30% of all sales. Investors and second-home purchases accounted for 18% of all sales. All-cash purchases accounted for 28% of all sales. Foreclosure and short-sales accounted for less than 1% of all sales remaining at a historic low.

California existing-home sales – The California Association of Realtors reported that existing-home sales totaled 426,970 on a seasonally adjusted annualized rate in March. That marked a 4.4% year-over-year drop from the number of homes sold in March 2021. Existing-home sales in the first quarter of 2022 are down 7.0% from the number of homes sold in the first quarter of 2021, which pretty closely matches the drop in the number of new listings. The median price paid for a home in March was $849,080, up 10.1% from February’s median price of $771,270. Year-over-year prices are up 11.9%. There was a 1.7-month supply of homes for sale in March, down form a 2-month supply of homes for sale in February, and unchanged from a 1.7-month supply of homes in March 2021.

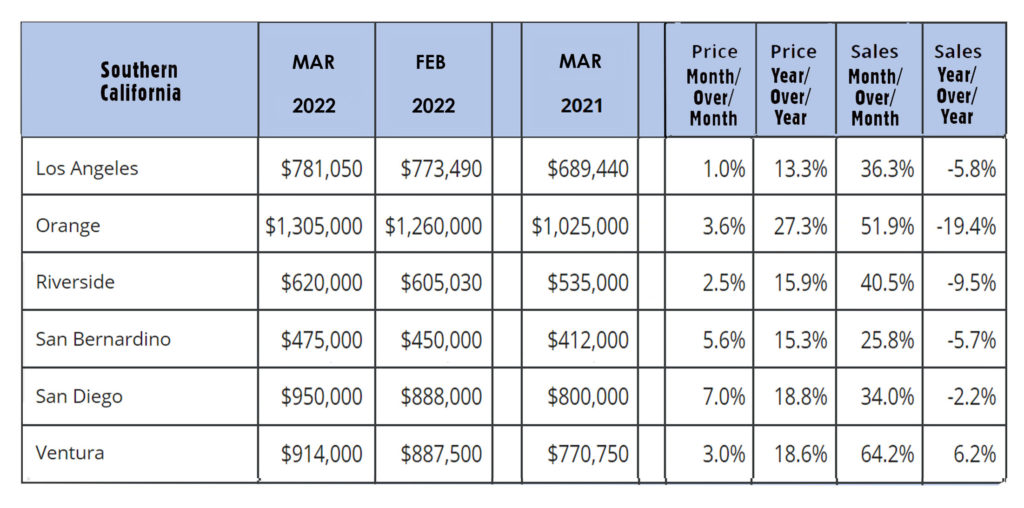

The graph below shows regional figures by county in Southern California.