Below is the Los Angeles Westside Market Report for March 2014 detailing local real estate market statistics and including year-over-year data:

Rodeo Realty Local Market Report–Conejo Valley-March 2014

Below is the Conejo Valley Market Report for March 2014 detailing local real estate market statistics and including year-over-year data:

Rodeo Realty Local Market Report–San Fernando Valley–March 2014

Below is the local market report for the San Fernando Valley for March 2014. The report details real estate market statistics with year-over-year data on median price and days on market.

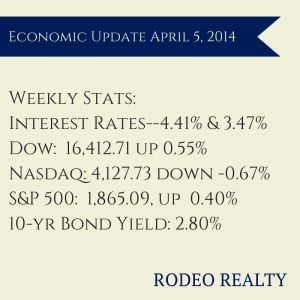

Economic Update For The Week Ending April 5, 2014 with Syd Leibovitch

The March Bureau of Labor Statistics jobs report was released Friday. It showed that the economy added 192,000 non farm jobs. This was welcome news after 3 months of much lower than expected gains, which were attributed to poor weather by many. January and February numbers were revised upward as well. The gains were all in the private sector, as government jobs showed no increase. The sectors with biggest job gains were: Professional and Business services, 57,000. Health care, 19,000. And Construction, 19,000. Construction has added 151,000 jobs over the last year. The March national unemployment rate held steady at 6.7%, the same rate it was at in February, however it did show that job creation is continuing at a steady pace. The labor force participation rate, or the proportion of working-age Americans who have a job or are looking for one rose to a six-month high of 63.2 % from 63% in February. This signals more people looking for work that had taken themselves out of the work force, as they are more optimistic about finding jobs than in the past.

The March Bureau of Labor Statistics jobs report was released Friday. It showed that the economy added 192,000 non farm jobs. This was welcome news after 3 months of much lower than expected gains, which were attributed to poor weather by many. January and February numbers were revised upward as well. The gains were all in the private sector, as government jobs showed no increase. The sectors with biggest job gains were: Professional and Business services, 57,000. Health care, 19,000. And Construction, 19,000. Construction has added 151,000 jobs over the last year. The March national unemployment rate held steady at 6.7%, the same rate it was at in February, however it did show that job creation is continuing at a steady pace. The labor force participation rate, or the proportion of working-age Americans who have a job or are looking for one rose to a six-month high of 63.2 % from 63% in February. This signals more people looking for work that had taken themselves out of the work force, as they are more optimistic about finding jobs than in the past.

The Dow rose this week to 16,412.71 up 0.55% from last week’s close of 16,323.06. Earlier this week, the Dow closed out the month at 16,457.66 up 0.83% from last month’s close of 16,321.90. It fell -0.7% for the quarter.

The Nasdaq however continued to fall. It dropped to 4,127.73 down -0.67% from last week’s close of 4,155.76 led by a plunge in biotech and internet stocks. The Nasdaq has lost 20% on 300 key stocks since its high point in early March and is now in bear market territory. The Nasdaq ended the month at 4,198.99 down -2.53% from last month’s close of 4,308.12. It rose 0.5% for the quarter.

The S&P 500 also rose, boosted by the jobs numbers, ending the week at 1,865.09, up 0.40% from last week’s 1,857.62 close but off a record high of 1,890.90 hit Wednesday after an ADP report showed job growth and the Commerce Department reported that factory orders rose 1.6% in February. The S&P 500 ended the month at 1,872.34, up 0.69% from last month’s 1,859.45 close. It gained 1.3% in the first quarter of the year.

The 10 year treasury bond yield ended the week at 2.80%. It was 2.73% last Friday and 1.78% a year ago. This signals an upward trend for Mortgage interest rates which closely follow the treasury bond market. Rates actually fell in January have been very steady since. This was mostly due to the disappointing December and January job numbers. With February and March numbers back in line with expectations, expect rates to continue to rise as they have in the last week.

The Freddie Mac Weekly Primary Mortgage Market Survey showed that the 30-year-fixed rate rose to 4.41%, the rate was 4.40% last week. The 15-year-fixed rose to 3.47% from last week’s 3.42%. They were more like 4.5% for 30 year and 3.5% for 15 year after the jobs report was digested yesterday. A year ago the 30-year fixed was at 3.54% and the 15-year was at 2.74%. Loans over $417,000 are more like 4.75% for 30 year and 3.75% for 15 year fixed terms today.

U.S. construction spending showed a slight increase in February, up 0.1% in February after a 0.2% drop in January. The Commerce Department reported that construction stands at a seasonally adjusted annual rate of $945.7 billion, 8.7% above the level of a year ago. Residential construction dropped 0.8%, the biggest setback since July. This is believed to be a temporary drop.

CoreLogic reported home prices rose 0.8% month over month from January and 12.2%compared to February 2013. This represents 24 months of consecutive year-over-year price increases. CoreLogic’s month-to-month prices aren’t adjusted for seasonal patterns. California was one of the five states with the highest home appreciation at 19.8%. CoreLogic predicts a10.5% year-over-year increase for March.

Zillow released a report this week showing that only around 43% of homes on the market in the Los Angeles area are affordable by historic standards, meaning that a family could buy the home and spend 35% or less of their household income. This is the number that was the average from 1985 through 2000 before the housing bubble. Today the average family would need to spend 39% of its income on a mortgage which is the highest rate of anywhere in the country.

All in all the Real Estate market seems to be in the mist of a spring pick up. Our closed escrows were up about 20% from February as the selling season has picked up steam. Some areas are beginning to see more listings, but most of our market suffers from very low inventory. We really need to see inventory levels increase before prices can level! With property and income tax due over the next two weeks it is possible we could see things cool off a little for a few weeks. It’s pretty common this time of year. If that should happen, don’t panic! It will roar back by the end of April!

Anjelica Huston Sells Legendary Venice Property With Rodeo Realty

As the L. A. Times reported this week, Anjelica Huston has sold her home in Venice for $11.15 million. Huston shared the one-of-a-kind five-story contemporary with her late husband, sculptor Robert Graham, who had his studio there. The home is steps away from Venice Beach and includes 13,796 square feet of loft-like live/work space with a dance studio, a gym, a library/study, a media room, an office, three bedrooms and 3.5 bathrooms. Gregory Bega of Sotheby’s International Realty and Mary Kay Nibley of Rodeo Realty were the listing agents.

As the L. A. Times reported this week, Anjelica Huston has sold her home in Venice for $11.15 million. Huston shared the one-of-a-kind five-story contemporary with her late husband, sculptor Robert Graham, who had his studio there. The home is steps away from Venice Beach and includes 13,796 square feet of loft-like live/work space with a dance studio, a gym, a library/study, a media room, an office, three bedrooms and 3.5 bathrooms. Gregory Bega of Sotheby’s International Realty and Mary Kay Nibley of Rodeo Realty were the listing agents.

Rodeo Realty's Wendy Furth Offers Advice On Selling An Imperfect House

Every house has someone who will buy it, love it, and treasure it. Some houses however, may have some imperfections that may make them a bit harder to sell. Recently Rodeo Realty Assistant Manager Wendy Furth spoke with reporter Marcie Geffner with her tips for making your house shine. Decluttering is one of the most important things you can do. Wendy advises that if you are not sure where to start, your Realtor can advise you as you go along.

Every house has someone who will buy it, love it, and treasure it. Some houses however, may have some imperfections that may make them a bit harder to sell. Recently Rodeo Realty Assistant Manager Wendy Furth spoke with reporter Marcie Geffner with her tips for making your house shine. Decluttering is one of the most important things you can do. Wendy advises that if you are not sure where to start, your Realtor can advise you as you go along.

She also recommends small things to make a home seem fresher: “Sometimes it’s as simple as taking down those awful curtains and having a good cleaning crew come in. Cleaning is always a good idea.” Even an inexpensive paint job and commercial-grade carpet can make a positive difference and prevent potential price cuts down the road.

Check out the full article on HSH.com.

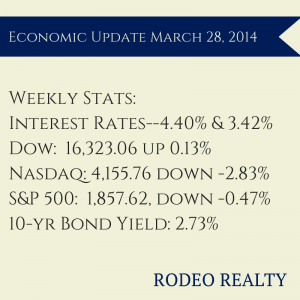

Economic Update For The Week Ending March 28 With Syd Leibovitch

L.A. County’s unemployment rate in February fell to 8.7% (from 8.9% in January) with employers adding 27,700 jobs to their payrolls (they lost 63,000 jobs in January). A year ago the rate was 10.2%. The statewide unemployment rate in February was 8%. Los Angeles and Long Beach both had 9.8% unemployment. Over the past 12 months, employers in L.A. County have added 86,000 jobs to their payrolls, for a growth rate of 2.1%.

L.A. County’s unemployment rate in February fell to 8.7% (from 8.9% in January) with employers adding 27,700 jobs to their payrolls (they lost 63,000 jobs in January). A year ago the rate was 10.2%. The statewide unemployment rate in February was 8%. Los Angeles and Long Beach both had 9.8% unemployment. Over the past 12 months, employers in L.A. County have added 86,000 jobs to their payrolls, for a growth rate of 2.1%.

It was a mostly down week in the markets. Friday saw a boost from the news that consumer spending rose in February at the fastest rate in several months, up 0.3% last month on a seasonally adjusted basis. Americans spent more money on health care and utilities but purchases of durable goods fell for the third month in a row. Also personal income rose 0.3% in March and the U.S. savings rate hit a four-month high of 4.3% from 4.2% in January. Inflation-adjusted disposable income was up 0.3%, the biggest advance in five months. The Dow rose this week to 16,323.06 up 0.13% from last week’s close of 16,302.70. The Nasdaq however dropped to 4,155.76 down -2.83% from last week’s close of 4,276.79 led by a plunge in biotech stocks. This was the worst week for the Nasdaq since October 2012. The S&P 500 also fell, ending the week at 1,857.62, down -0.47% from last week’s 1,866.40 close.

The ongoing effect of the Fed’s remarks last week continued to be felt on interest rates. The Freddie Mac Weekly Primary Mortgage Market Survey showed that the 30-year-fixed rate rose to 4.40%, the rate was 4.32% last week. The 15-year-fixed rose to 3.42% from last week’s 3.32%. A year ago the 30-year fixed was at 3.57% and the 15-year was at 2.76%.

The 10 year treasury bond yield ended the week at 2.73%. It was 2.75% last Friday.

The Commerce Department reported that sales of new U.S. single-family homes fell -3.3% in February to a seasonally adjusted annual rate of 440,000 units which is the lowest level seen since last September. The rate was down -1.1% compared to February 2013. Sales fell -15.9% in the West. January’s sales were also revised downward to a 445,000-unit pace from a 468,000-unit pace. Some of the slowdown continues to be blamed on unusually cold weather but economists are predicting a rush on homes as household formation begins to accelerate again with the improving economy. Inventory is at a 5.2 month supply, the highest level since December 2010. The median price of a new home was down -1.2% from February 2013.

Consumer confidence rose to its highest level in more than six years. The Conference Board indexrose to 82.3 in March compared to 78.3 the previous month. Consumers expect the economy to continue to strengthen and are showing optimism that both business conditions and the labor market will improve over the next six months.

The composite 20-city S&P/Case-Shiller home price index was up 13.2% in January from a year earlier with all 20 cities showing year-over-year gains. Prices in the 20-city index were 0.1% lower than the prior month, but that is mostly due to the cold winter throughout much of the country, adjusted for seasonal variations, prices were 0.8% higher month-over-month. For the Los Angeles metro area, prices were up 18.5% year over year and down -0.3% month over month (but up 0.4% once seasonally adjusted).

The National Association of Realtors® reported that its seasonally adjusted pending home sales index was down -0.8% to 93.9., it was down -10.5% from February 2013. A combination of cold weather, higher mortgage rates, and limited inventory have cramped the market but most economists are expecting a spring rebound.

The California Association of Realtors® however saw that pending sales were up in February, jumping 14.2% from January but down -12% from last February. The index rose from 84.8 in January to 96.8 in February and was 110.1 in February 2013. Distressed sales continue to be a smaller part of the market. Equity sales were up statewide, increasing to 85% from January’s 84.4%. In Los Angeles, single-family distressed sales were 14% of the market compared to 16% in January and 32% one year ago.

Next week will be a big week for economic news. Perhaps the most telling report that could impact interest rates is the jobs report which will come out at the end of next week. Expect rates to rise on a good report, 180,000 new jobs or more. Expect rates to remain stable at 160,000 or so, and if the report comes in much lower rates could drop! Good news for the economy is bad news for interest rates ( they rise), and bad economic news is good news for rates ( they fall).

Locally we are seeing a spring surge in prices. we are not seeing as many new listings as we would usually see in March, but I would expect many more in the next few months!

Rodeo Realty Architectural Lecture Series Welcomes Eleanor Schapa

Recently noted architectural lecturer Eleanor Schrader Schapa met with Rodeo Realty agents for an inspiring morning full of architectural history and information. While naysayers in other areas may say that Los Angeles lacks culture, the opposite is true especially when it comes to great architecture. The architecture of Los Angeles reflect the city’s role as home to many different cultures. There are two main periods that influence much of architectural style in the area. The first is of course the mission period. Missions were established in Southern California partly to keep others, including Russian fur traders, from making a land grab. The oldest standing house in Los Angeles is the Avila Adobe, built in 1818 and now open as a museum. The classic adobe walls are several feet thick. In 1850 Phineas Banning established the Port of Los Angeles. Like many new arrivals he brought the styles from the East Coast with him. His home, in Wilmington, California, is also now a museum and reflects the Greek Revival style that was popular at the time.

Recently noted architectural lecturer Eleanor Schrader Schapa met with Rodeo Realty agents for an inspiring morning full of architectural history and information. While naysayers in other areas may say that Los Angeles lacks culture, the opposite is true especially when it comes to great architecture. The architecture of Los Angeles reflect the city’s role as home to many different cultures. There are two main periods that influence much of architectural style in the area. The first is of course the mission period. Missions were established in Southern California partly to keep others, including Russian fur traders, from making a land grab. The oldest standing house in Los Angeles is the Avila Adobe, built in 1818 and now open as a museum. The classic adobe walls are several feet thick. In 1850 Phineas Banning established the Port of Los Angeles. Like many new arrivals he brought the styles from the East Coast with him. His home, in Wilmington, California, is also now a museum and reflects the Greek Revival style that was popular at the time.

Los Angeles has attracted many different styles of buildings. Although there are some excellent examples of Victorian and Italianate architecture throughout the city, the style doesn’t quite reflect how people in this area prefer to live, in larger open rooms with plenty of light and space. The restrictive nature of Victorian homes and the ornate syle of Beaux Arts led to the response that was the arts and Crafts movement. Arts and Crafts was a return to simplicity, to styles that were considered to be more organic and of the earth. Famed furniture maker Gustave Stickley espoused this view in his magazine, The Craftsman. Sears took the idea of Stickley’s floor plans and designs and sold a variety of kits that contained everything necessary to build the home of your dreams.

The Art Deco period was also a time of the flowering of Los Angeles as the movie industry moved from New Jersey to Los Angeles. This time period saw a variety of styles, in particular the Spanish Revival with red tile roofs and thick adobe walls. Schapa pointed out two very interesting features about these homes. The first is that those red tiles that are often on the roofs of these homes actually get their curved shapes from clay being shaped over the workers’ thighs. The second is that the particularly pointed yet wide arch seen in many of these homes including the Adamson House, is actually not a Gothic arch but is instead a donkey arch, named for a type of arch popular in Mexican architecture that gets its name from the room needed to pass a rider and donkey laden with packages through it.

Although we have a variety of styles here, from the cutesy charms of English Tudor, French Normandy and Storybook homes to the sleek lines of Streamline Moderne and International style, Southern California is probably most famous for its mid-century moderns. The Case Study homes including the Eames house and the Schulman-photographed Stahl house represented the start of something amazing, a new view of home architecture for the post-war era. These angular beauties, with their minimalist lines and ample use of glass usher in the era of the Los Angeles lifestyle. Schapa touched upon the popularity of the ranch home as seen at the time both on television and in the pages of Sunset magazine. It was the age of the martini, the wide-bodied American car, the swimming pool, and the nuclear family.

Los Angeles uniquely seems to embrace all styles. As with food, culture, art, and more, we seem to have room enough for all of it. It’s a major part of what makes this such a fascinating place to live and work. Schapa’s lecture reminded all agents not just of the beauty of the homes they see every day but of the rich legacy they represent.

Rodeo Realty Agent Jay Geisenheimer Featured In The California Horsetrader

Proving that Burbank is a horse town, Rodeo Realty Studio City agent and equestrian estates director Jay Geisenheimer was featured in an article in the California Horsetrader. The Burbank Rancho is a place where those who love horses can enjoy trail riding and take advantage of many local boarding and training stables. The area also features many horse shows and events taking place at the nearby Los Angeles Equestrian Center.

Proving that Burbank is a horse town, Rodeo Realty Studio City agent and equestrian estates director Jay Geisenheimer was featured in an article in the California Horsetrader. The Burbank Rancho is a place where those who love horses can enjoy trail riding and take advantage of many local boarding and training stables. The area also features many horse shows and events taking place at the nearby Los Angeles Equestrian Center.

In the article, Jay discusses, the value of local real estate as well as the sense of neighborliness in the Burbank Rancho area. In the article Jay says: “Although around half the Rancho is non-equestrian used properties, the presence of horses brings a country aura to the community. The Rancho has a small-town feeling. Residents know each other by their horses’ names and the camaraderie is tremendous.” Jay also discussed the value of property in the Rancho area, noting that property values have soared.

Rodeo Realty Agent Ron Tanzman Quoted In The Wall Street Journal

Renting a room or apartment in a luxury home can be the best of both worlds, it’s a chance to experience a beautiful way of living without paying the full mortgage.

The Wall Street Journal recently ran a story on the phenomenon of luxury home owners sharing their homes with tenants. The lead image of the story featured Rodeo Realty Calabasas agent Ron Tanzman, who rents a part of his 6,500-square-foot Mediterranean home in Calabasas to an attorney who pays rent and a portion of utilities.In the article Ron highlights the benefits of the arrangement: “It’s a big house, so it’s kind of nice to have the company.” His renter Lori Amedei also looks in on his dogs.