Check out all the great things happening at Rodeo Realty in the month of February! Big sales, big listings, major events, news coverage and more…

Rodeo Realty Agent Eydie Herrera Appointed to SRAR Governmental Affairs Committee

Rodeo Realty is pleased to announce that REALTOR®, Eydie Herrera has been appointed by the Southland Regional Association of Realtors, Inc. (SRAR) as a Committee Member to the Governmental Affairs Committee (GAF) for a second term.

Rodeo Realty is pleased to announce that REALTOR®, Eydie Herrera has been appointed by the Southland Regional Association of Realtors, Inc. (SRAR) as a Committee Member to the Governmental Affairs Committee (GAF) for a second term.

A REALTOR®since 1995, Eydie has experience in working with government officials both professionally and personally. She previously worked for the Navy’s Center for Asymmetric Warfare (CAW), and served as a liaison for the Center with high ranking military officials, local and congressional representatives. She also represented her community with a number of issues related to business growth and quality of life issues for residents. She tackled issues such as; cell tower placement, safety and security issues and was key to the development of policies that would protect the community when Walmart made a request to expand their liquor department.

In her role serving on the Governmental Affairs Committee she will have input on legislative matters, environmental and community issues that are of concern to property owners and REALTORS® with primary emphasis on local issues.

The general purpose of the GA Committee is to take positions and offer input on legislative matters, along with environmental and community issues that are of concern to property owners and REALTORS® with primary emphasis on local issues; to develop and maintain close relationships with legislators representing the San Fernando and Santa Clarita Valleys through frequent meetings and correspondences.

Eydie said, “There is a much larger group of appointees this year than in previous years.” “The GAF has a plan to increase the communication between REALTORS®and the community and to be instrumental in providing a ‘grass roots’ effect on legislative issues that we champion.”

Eydie looks forward to expanding her ability to serve her community and can be reached at 818-486-6451 or re@remadeasy.com.

Rodeo Realty President Syd Leibovitch Completes Visits With Top European Agents

Real estate is in many ways a universal language and luxury real estate even more so. Rodeo Realty President Syd Leibovitch spent the last week in Europe, meeting with directors of some of the top real estate agencies in both Paris and Vienna. It was important to Syd to connect with these influential leaders face-to-face. Often we talk to people online, through email, or over the phone but there is still nothing like a meeting in person, preferably over a good meal, to create a real working relationship.

Real estate is in many ways a universal language and luxury real estate even more so. Rodeo Realty President Syd Leibovitch spent the last week in Europe, meeting with directors of some of the top real estate agencies in both Paris and Vienna. It was important to Syd to connect with these influential leaders face-to-face. Often we talk to people online, through email, or over the phone but there is still nothing like a meeting in person, preferably over a good meal, to create a real working relationship.

In Paris, in a meeting arranged by Prestige MLS, Syd met with Hugues de la Morandiere of Agence Varenne, Richard Bellanger of Haussman Prestige, Joseph Arida of Odgamm Prime Realty, and Thierry Tocaier of Ternes Elysees Immobilier. In Vienna, Syd met with Thilo Boerner of Boerner.at and other Viennese agents.

The meetings paved the way for future collaborations between Rodeo Realty and leading international agents. We can’t wait to welcome members of Prestige MLS when they visit Los Angeles for a tour of luxury real estate in May.

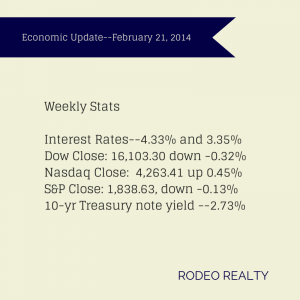

Economic Update For The Week Ending February 21, 2014 with Syd Leibovitch

Stocks were mixed this holiday-shortened week responding to a mixed bag of news. Inflation reports show inflation remains low. In January, overall prices rose 1.6% from a year ago. Prices of most commodities rose modestly while the shelter index was up at 2.6% compared to a year ago because rents are rising.

Stocks were mixed this holiday-shortened week responding to a mixed bag of news. Inflation reports show inflation remains low. In January, overall prices rose 1.6% from a year ago. Prices of most commodities rose modestly while the shelter index was up at 2.6% compared to a year ago because rents are rising.

The Dow closed out the week at 16,103.30 down -0.32% from last week’s close of 16,154.39. The Nasdaq was up, ending the week at 4,263.41 up 0.45% from last week’s 4,244.03 close. The S&P 500 was down very slightly, closing the week at 1,838.63, down -0.13% from last week’s 1,838.63 close.

The 10-year Treasury note yield rate was down slightly to 2.73% after ending last week at 2.75%. It was 1.99% a year ago.

Mortgage Interest rates rose slightly this week. The Freddie Mac Weekly Primary Mortgage Market Survey showed that the 30-year-fixed rate up to 4.33% from 4.28% last week. The 15-year-fixed inched up to 3.35% from last week’s 3.33%. A year ago the 30-year fixed was at 3.56% and the 15-year was at 2.77%. Interest rates on loans over $417,000 are around 4.625% for 30 year fixed and 3.625% on 15 year fixed.

Low inventory continues to have a constraining effect on California home sales. The California Association of Realtors® reported that closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 363,640 units in January, marking the third straight month that sales were below the 400,000 level and the sixth straight decline on a year-over-year basis. Sales in January were up 0.3% from a revised 362,430 in December but were down -13.8% from a revised 421,780 in January 2013. Inventory at the higher end of the market, priced $1 million and higher did increase 11.1% from last year. The statewide median price of an existing, single-family detached home fell -6.2% from December’s revised median price of $438,090 to $410,990 in January. January’s price was 22.1% higher than the revised $336,650 recorded in January 2013, marking 23 consecutive months of year-over-year price increases and the 19th straight month of double-digit annual increases. The available supply of existing, single-family detached homes for sale rose in January to 4.3 months, up from December’s Unsold Inventory Index of 3 months. The index was 3.5 months in January 2013. The median number of days it took to sell a single-family home also increased to 44.3 days in January, up from 40.2 days in December and from a revised 36.7 days in January 2013.

In Los Angeles County alone, the median sold price of existing homes was down –3.7% in January from December’s $439,830 to $423,570 which is up 21.1% from January 2013’s $349,720 median price. Total sales were down– 21.2% month over month and down -13.3% from January 2013.

Data from the National Association of Realtors® showed that existing-home sales fell by -5.1%from December to January to a seasonally adjusted annual rate of 4.62 million the lowest level since July 2012. Home sales were also down -5.1% year over year. The cold weather, low inventory, and rising mortgage rates are cited as potential reasons for the lower numbers. Inventory improved modestly, up 2.2% month over month to 1.9 million homes and up 7.3% from January 2013. The current inventory supply rate is now 4.9 months, up from 4.6 months in December and 4.4 months a year ago. The median existing home price for all housing types nationwide in January was $188,900, up 10.7% from January 2013. The median time on market for all homes was 67 days in January, down from 72 days in December and 31% of homes sold in January were on the market for less than a month. Existing-home sales in the West dropped -7.3% to a pace of 1.01 million in January, and are -13.7% below a year ago. The median price for the West was $273,500, up 14.6% from January 2013.

The latest foreclosure data from RealtyTrac shows that one in every 1,058 U.S. homes received a foreclosure filing in January. Foreclosure filings are down -18% from January 2013 but up 8% from December 2013. The rise in foreclosure activity was caused by a surge in starts, properties just entering foreclosure, as well as scheduled foreclosure auctions. The report did show that foreclosure starts in California actually rose 57% from a year ago after 17 consecutive months of annual decreases.

The extreme weather that has hammered much of the country seems to have also impacted homebuilder confidence. The National Association of Home Builders/Wells Fargo Builder Sentiment Index is now 46, down from January’s 56 reading and the lowest level since May. Economists had been predicting a number similar to the one they saw in January. Generally a reading below 50 indicates that more builders see sales conditions as poor rather than good. Builders’ prediction for sales over the next six months also fell by six points to 54.

U.S. housing starts saw their biggest drop in nearly three years last month. The U.S. Census Bureau and the Department of Housing and Urban Development reported that single-housing family starts were down -16% in January to a seasonally-adjusted annual rate of 880,000 units below economists’ predictions of 950,000. This was attributed to the unusually cold weather gripping much of the country and in fact in the hard-hit Midwest, starts were down a record -67.7%. Groundbreaking for single-family homes, the largest segment of the market, fell 15.9 percent to a 573,000-unit pace in January, the lowest level since August 2012. Permits to build homes were down by -5.4% in January, the largest drop in since June.

The National Housing Trend Report from realtor.com® showed that the median list price for January rose 8.3% compared to last year but only up 0.1% from the previous month. The number of properties for sale was up 3.1% for the year but down -3.3% from the previous month. The median age of inventory was essentially unchanged. For the Los Angeles-Long Beach MSA the median price was $449,000 up 25.1% from a year ago but down -0.20% from the previous month. The amount of total listings was 18,600 up 3.40% from the previous year and up 5.10% from the previous month. The median age of inventory was 74 days, down -5.1% from the previous year and down -1.3% from the previous month.

We are heading into the selling season which will be a welcome relief when it comes to real estate related data. Expect to see the month over month indicators pick up after March! Not only do they pick up at that time every year, we are beginning to see the pick up in the marketplace.

While inventory levels are still near record lows we are beginning to see many more homes listed in many of our markets. That alone should increase the number of sales as we still see stronger demand than inventory supply which is evident by the high number of multiple offers. Obviously, not all homes are getting multiple offers, there is a limit to how high a home can be priced. Homes that are not well priced are sitting on the market.

Luxury Videos Sell Rodeo Realty Properties

Last summer Rodeo Realty agent Josh Flagg appeared on ABC to discuss the trend of luxury real estate videos used to sell properties. Since then the creation of these videos has only increased and Rodeo Realty agents have created some lavish movie-style videos highlighting not just the beauty of the properties but also the lifestyle that the home creates. The results have been extraordinary. A few of our recent favorites:

Last summer Rodeo Realty agent Josh Flagg appeared on ABC to discuss the trend of luxury real estate videos used to sell properties. Since then the creation of these videos has only increased and Rodeo Realty agents have created some lavish movie-style videos highlighting not just the beauty of the properties but also the lifestyle that the home creates. The results have been extraordinary. A few of our recent favorites:

Recently Rodeo Realty agent Ben Salem had a on the market for a while and it had a few offers but the pictures didn’t tell the whole story. He shot a lifestyle video that showed the home’s hiking trails, garden, and more. He had another brokers open and was flooded with brokers who said their clients had seen the video. He’s now fielding multiple offers. Now he’s sold on lifestyle videos to sell luxury homes!

Rodeo Realty agent Jennifer Winchell has also used video to showcase the views and pool at her listing at 7080 Mulholland Dr. The video brings attention to some of the home’s more extraordinary features including the custom LED lighting and the wall of water at the entrance. The video also allows the viewer to see what the home looks like in different types of light, showing both the glittering city lights as well as the peace of a tranquil sunset.

Most recently listed from Rodeo Realty agent Ben Bacal is 9380 Sierra Mar, a trophy home in the Bird Streets. This home caught media attention and received press mentions, not just for the beauty of the home but for the marketing materials. The luxurious infinity pool which is only enhanced by the addition of a lovely bathing beauty taking in the view.

These luxury properties are just a few examples of the innovative new ways properties are being marketed at Rodeo Realty.

Sherman Oaks Office Is The Latest Rodeo Realty Renovation

Rodeo Realty has been on a renovation journey, always innovating to keep pace with changing times. It began last summer when Rodeo Realty moved corporate headquarters to a new state-of-the-art facility on Wilshire Blvd. in Beverly Hills. The new space represented an opportunity to start from scratch and create a new design that better reflected a boutique luxury real estate firm.

Rodeo Realty has been on a renovation journey, always innovating to keep pace with changing times. It began last summer when Rodeo Realty moved corporate headquarters to a new state-of-the-art facility on Wilshire Blvd. in Beverly Hills. The new space represented an opportunity to start from scratch and create a new design that better reflected a boutique luxury real estate firm.

The design was such a success that it is now being adapted to other offices. At the end of last year Rodeo Realty Northridge was remodeled and now the Sherman Oaks office is the latest to receive a new look. The process began in late January and is now complete. Agents have a new fully modernized home base that offers not only a great place to work but a place to bring clients. “Sherman Oaks looks fantastic!” says manager Jason Katzman. “We now have a modern look with a high tech design.”

Newest House of Cards Star Has Rodeo Realty Connection

Many people across the country spent Presidents Day weekend (and Valentine’s Day) glued to their televisions binge-watching House of Cards. The whole second season of the popular series was released on Netflix on February 14, prompting many people to skip the hearts and flowers and stay in for the machinations of the Underwoods instead. Early reports indicate that the Netflix saw a huge bump in viewing associated with the show.

Many people across the country spent Presidents Day weekend (and Valentine’s Day) glued to their televisions binge-watching House of Cards. The whole second season of the popular series was released on Netflix on February 14, prompting many people to skip the hearts and flowers and stay in for the machinations of the Underwoods instead. Early reports indicate that the Netflix saw a huge bump in viewing associated with the show.

At Rodeo Realty we were particularly interested to watch to see Mozhan Marnò who plays Ayla Sayyad, the tenacious journalist for the Washington Telegraph determined to get to the bottom of the Underwood secrets. Mozhan is the daughter of Rodeo Realty’s own Sophie Dabestani. Her daughter has appeared on many TV series before but there’s something special about appearing on a program that had everyone glued to their televisions all weekend long. Congrats to Sophie and Mozhan!

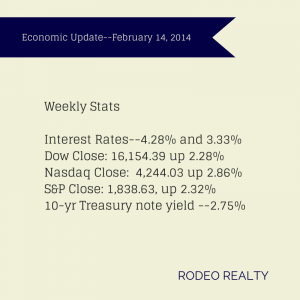

Economic Update For The Week Ending February 14, 2014 With Syd Leibovitch

This week the stock market saw another week of positive territory with strong gains seen in all three indices as investors took into account bad weather as an excuse for some soft economic data. While U.S. export prices rose 0.2% in January, the third straight monthly increase, factory production fell 0.8% in January, the biggest drop in more than 4-1/2 years. The Dow closed out the week at 16,154.39 up 2.28% from last week’s close of 15,794.08. The Nasdaq was also up, ending the week at 4,244.03 up 2.86% from last week’s 4,125.86 close. The S&P 500 ended the week at 1,838.63, up 2.32% from last week’s 1,797.02 close.

This week the stock market saw another week of positive territory with strong gains seen in all three indices as investors took into account bad weather as an excuse for some soft economic data. While U.S. export prices rose 0.2% in January, the third straight monthly increase, factory production fell 0.8% in January, the biggest drop in more than 4-1/2 years. The Dow closed out the week at 16,154.39 up 2.28% from last week’s close of 15,794.08. The Nasdaq was also up, ending the week at 4,244.03 up 2.86% from last week’s 4,125.86 close. The S&P 500 ended the week at 1,838.63, up 2.32% from last week’s 1,797.02 close.

The 10-year Treasury note yield rate rose slightly to 2.75% after ending last week at 2.71%. It was 2.00% a year ago.

Interest rates saw a slight rise this week after several lower weeks. The Freddie Mac Weekly Primary Mortgage Market Survey showed that the 30-year-fixed rate up to 4.28% from 4.23% last week. The 15-year-fixed stayed solid at 3.33% the same as last week’s 3.33%. A year ago the 30-year fixed was at 3.53% and the 15-year was at 2.77%.

The latest quarterly report from the National Association of Realtors® shows that the

median existing single-family home price increased in 73% of measured markets, with 119 out of 164 metropolitan statistical areas (MSAs) showing gains based on closings in the fourth quarter compared with the fourth quarter of 2012. Forty-two areas, 26 % had double-digit increases. The national median existing single-family home price was $196,900 in the fourth quarter, up 10.1% from $178,900 in the fourth quarter of 2012. In the third quarter the median price rose 12.5% from a year earlier. In the West, existing-home sales dropped -12.7% in the fourth quarter, and are -8.1% below a year ago. Lack of inventory remains a concern. The median existing single-family home price in the West jumped 15.5% to $286,200 in the fourth quarter from the fourth quarter of 2012.

Credit reporting agency TransUnion released a report showing that the amount of late payments on home loans has hit the lowest level in more than 5 years. Nationwide, 3.85% of mortgage holders were at least two months behind on their payments in the October-December quarter, compared to 5.08% a year before.

The California Association of Realtors®reported that the percentage of home buyers who could afford to purchase a median-priced, existing single-family home in California in the fourth quarter of 2013 was unchanged from the third quarter of 2013 at 32%, but was down from 48% in fourth-quarter 2012, according to C.A.R.’s Traditional Housing Affordability Index (HAI). Home buyers needed to earn a minimum annual income of $89,240 to qualify for the purchase of a $431,510 statewide median-priced, existing single-family home in the fourth quarter of 2013.The median home price was $352,450 in fourth-quarter 2012, and an annual income of $66,860 was needed to purchase a home at that price. California housing affordability hit a record high of 56% in first quarter of 2012 but has steadily declined since then. In Los Angeles the affordability index in the fourth quarter of 2013 was 34%, down from the third quarter’s 35% and much reduced from the fourth quarter of 2012’s 50%.

DataQuick reported that home prices fell 3.8% in January compared with December and sales were down -9.9% year over year, though the median price was up 18.4% compared with January of last year. January’s median home price, $380,000, is the lowest since May 2013. For the six-county Southland area 14,471 new and resale homes and condos were sold last month, a three-year low for January. For Los Angeles alone, 5,308 homes were sold, a -7.4% decrease from January 2013. The median price however rose 20.6% from $340,000 to $410,000.

There was an article this week in the L.A. Times about home prices stalling. A broker was quoted in the Inland Empire. That is not what is happening here! I doubt it’s happening there either. We definitely need more homes on the market as we are seeing record sales prices! We all should have bought more Real Estate in the last few years. Let’s not be saying the same thing at years end!

Conejo Valley Local Market Report–January 2014

Below is the Conejo Valley Market Report for January 2014 detailing local real estate market statistics and including year-over-year data:

Rodeo Realty San Fernando Valley Local Market Report–January 2014

Below is the local market report for the San Fernando valley for January 2014. The report details real estate market statistics with year-over-year data on median price and days on market.