Stock markets rise again this week – Stock markets, after dropping about 5% in September, have rebounded in October. Economic data points to the economy continuing its expansion. Early reporting of corporate earnings have shown strong corporate profits. Retail sales, which seemed to stall in July August, were up over 14% year-over-year in September. The Dow Jones Industrial Average closed the week at 35,294.76, up 1.6% from 34,746.25 last week. It is up 15.4% year-to-date. The S&P 500 closed the week at 4,471.37, up 1.8% from 4,391.34 last week. It is up 18.9% year-to-date. The NASDAQ closed the week at 14,897.34, up 2.2% from 14,579.54 last week. It is up 15.5% year-to-date.

U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 1.59%, down from 1.61% last week. The 30-year treasury bond yield ended the week at 2.05%, down from 2.16% last week. We watch bond yields because mortgage rates often follow treasury bond yields.

Mortgage rates – The October 14, 2021, Freddie Mac Primary Mortgage Survey reported mortgage rates for the most popular loan products as follows: The 30-year fixed mortgage rate was 3.05%, up from 2,99% last week. The 15-year fixed was 2.30%, up from 2.23% last week. The 5-year ARM was 2.55% up slightly from 2.52% last week.

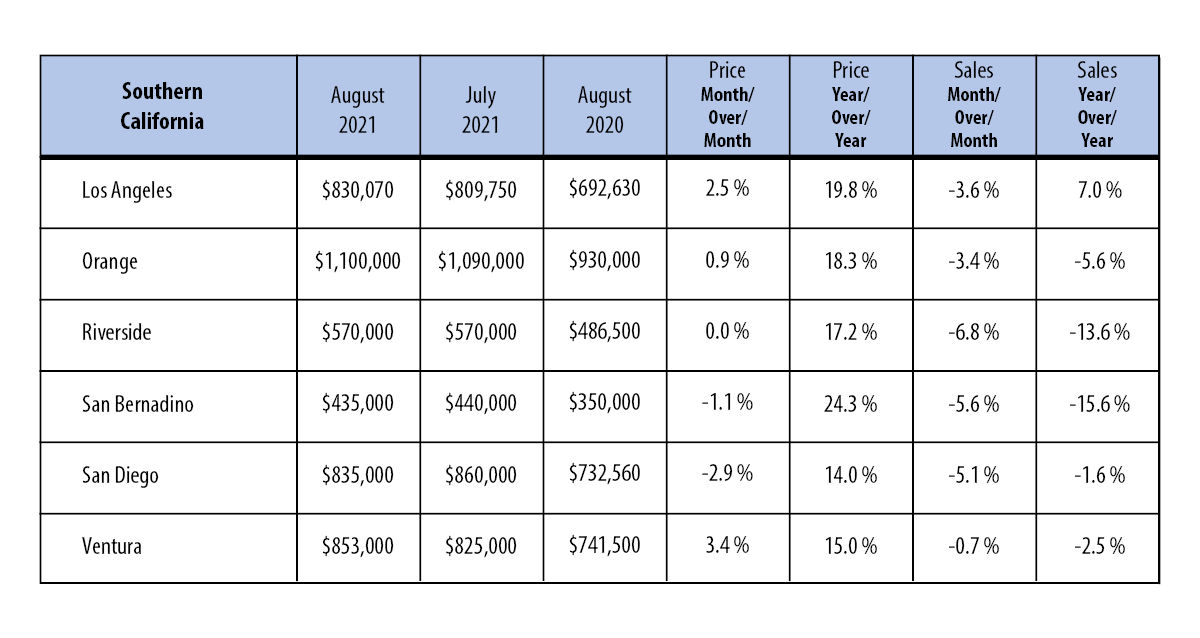

2022 housing forecast – The California Association of Realtors released its 2022 housing market forecast this week. They expect the number of homes sold in 2022 to be decline by about 5.2% to 416,800 units. They have projected 439,800 sales in 2021. 2022’s projection of 419,800 sales, while less than 2021, would be the second highest number of sales in the last five years. They expect the median price to rise 5.2% to $834,400 in 2022. While still a healthy increase it’s a ways off from the projected historic 20.3% increase in the median price in 2021. They forecast interest rates on 30-year fixed mortgages to be at or above 3.5%. While about 1/2% higher than rates are today, that’s a very low interest rate and still near historic lows.

2022 CALIFORNIA HOUSING FORECAST

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021p | 2022f | |

| SFH Resales (000s) | 409.4 | 417.7 | 424.9 | 402.6 | 398.0 | 411.9 | 439.8 | 416.8 |

| % Change | 7.00% | 2.00% | 1.70% | -5.20% | -1.20% | 3.50% | 6.80% | -5.20% |

| Median Price ($000s) | $476.3 | $502.3 | $537.9 | $569.5 | $592.4 | $659.4 | $793.1 | $834.4 |

| % Change | 6.60% | 5.40% | 7.10% | 5.90% | 4.00% | 11.30% | 20.30% | 5.20% |

| Housing Affordability Index* | 31% | 31% | 29% | 28% | 31% | 32% | 26% | 23% |

| 30-Yr FRM | 3.90% | 3.60% | 4.00% | 4.50% | 3.90% | 3.10% | 3.00% | 3.50% |

September California and U.S. home sales figures will be released by the California Association of Realtors, and the National Association of Realtors next week.